The massive drawdown in Bitcoin on December 5th was not fully mirrored in other markets. Why not?

Make a new high, then wash out all the leveraged longs.

It surprises no one these days that a new high was followed by a price drop as brutal as it was brief. The drop that lasted about eight hours was a bit over 11% but the market had nearly recovered less that a day later.

More surprising was the, relative, lack of a price drop collapse in other crypto markets.

Ethereum did have a bit of a drop. From the top to the short-lived bottom eight hours later the decline was only 7%.

Ethereum

Solana experienced a larger, 7.8%, decline. But it was still less than that in Bitcoin.

Solana.

And the less liquid SUI did not even drop a full 7%.

SUI.

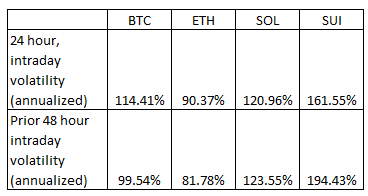

If we look at this in terms of volatility, measured on 15 minute moves, we see that Bitcoin’s volatility increased. Ethereum saw a small rise in volatility, while SOL and SUI both actually declined in vol.

Historical volatility, 15 minute increments, the 24 hours around the flash crash and the 48 hours prior.

So, why did the largest, most liquid market drop the most? Were people too busy monitoring the Bitcoin decline to sell the others? Or was it something else?

Flash crashes are caused by rapid, panicked position exits. In conventional markets, these can be stop loss orders, hurried market orders from participants making a conscious decision, or liquidated positions. In crypto markets, we can have all of these, but pre-programmed liquidations make up the largest part of the selling.

To get a sense of just where the liquidations took place, we look at Binance’s perpetual futures volume. This market exceeds all others in volume by a large margin, but others look similar. Bitcoin trades more than double Ethereum’s volume. Solana and SUI trading reaches only 11% and 3.9% respectively of Bitcoin’s volume.

Perpetual Futures volume, by asset.

So, what do all these numbers mean? Leveraged products are easily liquidated. We have examined here before how liquidation risk is higher than most traders people expect. When a market has billions of dollars of positions that will be liquidated, you get this sort of stampede or, more accurately, avalanche. One liquidation leads to selling, which can trigger more liquidations and more selling. This selling, in turn leads to more. And it continues until the leveraged positions are gone.

In additional little twist of fate, trades who believe they have not used excessive leverage suffer along with their highly leveraged comrades. The liquidation of the insanely high leverage 50x trades triggers the selling that triggers liquidation of the 40x and 30x trades. Those, in turn, trigger the 20x, which hits the 10x. So even if you think you did not push your leverage too far, someone else’s irresponsible trade eventually hits you.

At Outcome Trading, we have built a platform, soon to be released, where traders cannot be liquidated. Once active, it will be a safe (or, at least, safer) haven for traders to establish positions in the market without fear of someone else’s crazy trade forcing them out at the low.